California’s Department of Health Care Services (DHCS) is in the final stages of establishing new Medical Loss Ratio (MLR) requirements in Medi-Cal Managed Care. Most significantly, the guidelines specify that the MLR program, which previously applied to Medi-Cal managed care plans, will now also apply to certain of their subcontractors, including risk-bearing providers.

What are MLR standards?

MLR standards are a commonly used metric to identify how much of an enrollee’s premium is spent on medical care. Medical care, used here, is a broad term that includes quality expenses, among other things. The industry standard is to have an 85% MLR target: at least 85% of the managed care plan’s premium should be spent on medical care. Since 2017, DHCS has placed MLR reporting requirements on managed care plans. (Cal. Welf. & Inst. Code § 14197.2.)

MLR standards are a commonly used metric to identify how much of an enrollee’s premium is spent on medical care. Medical care, used here, is a broad term that includes quality expenses, among other things. The industry standard is to have an 85% MLR target: at least 85% of the managed care plan’s premium should be spent on medical care. Since 2017, DHCS has placed MLR reporting requirements on managed care plans. (Cal. Welf. & Inst. Code § 14197.2.)

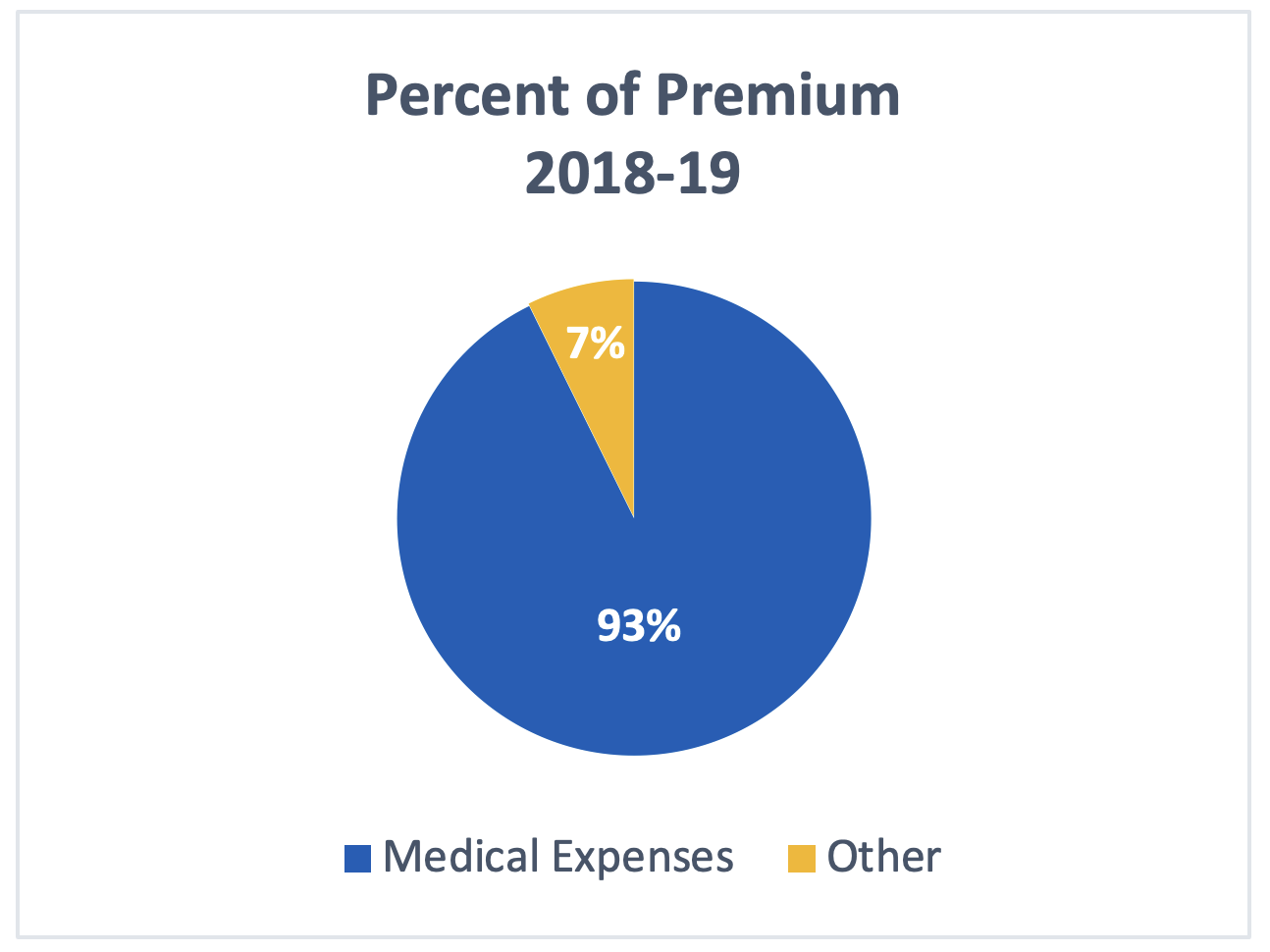

MLR for Medi-Cal Managed Care Plans was last published by DHCS in FY 2018-19. Plans reported that they spent 92.7% of the Medi-Cal premium on medical care. See plan spending in the chart to the right.

What is changing?

With the new MLR requirements, 2024 will be the first year managed care plans must rebate funds to DHCS if they do not meet the 85% MLR target. (Id.)

More notable, however, is that in December 2021, Centers for Medicare and Medicaid Services (CMS) approved California’s section 1915(b) Cal AIM waiver, which extended the MLR requirements to certain subcontractors, e.g., IPA groups, Risk Bearing Organizations (RBOs) and Restricted Knox-Keene Licenses (RKKs). This means that for 2023 and 2024 rating periods, the reporting requirements will be required of the plan’s subcontracting delegated entities. Following that, in 2025, subcontracting delegated entities will also have to make remittance payments if they do not meet the 85% MLR target.

While not yet released, the final guidelines are expected to detail who the subcontractor requirements apply to, and how expenses and revenue amounts required in the calculation are to be defined. Until those final guidelines are released, we will not know definitively, but, based on other DHCS guidance, we can assume that the MLR reporting requirements will likely apply to the following subcontracting delegated entities:

- Subcontracting Plans or plans that assume fully or partially delegated risk and are not directly contracted with DHCS in that service area; and

- Subcontractors, except Subcontractor Plans, that assume risk and receive payment for services provided beyond their own entity. This may include IPAs, medical groups, hospital systems, or other entities.

These organizations must prepare for the new MLR reporting requirements and, most importantly, the potential for future remittance. Once the MLR reporting requirements are in effect, it is essential that these organizations categorize, track, and report costs in accordance with the MLR guidelines. Generally, subcontracting providers have not had to categorize and track this data. For some providers, this may mean an overhaul of their financial and medical data tracking systems, which takes time and funds.

There are a few keys to making sure an organization correctly reports appropriate levels of medical expenses:

- Ensuring all medical encounters are tracked and reported;

- Understanding what administrative services and other various costs are able to be labeled as medical care under the reporting requirements; and

- Actually tracking and reporting all medical costs to ensure that an organization does not have to make remittance payments.

What do we know so far?

Although final guidance hasn’t been released, DHCS released initial guidance indicating that for at least the next two years, it will adopt the "Four-Part Test" until final guidance is released. The Four-Part Test is currently used by the CMS and helps determine whether payments to a clinical risk-bearing entity are considered “incurred claims” and can be counted as a medical expense. (CCIIO Technical Guidance (CCIIO) 2012—001, pg. 1.)

Payments are considered incurred claims if all of the following four factors are met:

- The organization contracts with an issuer to deliver, provide, or arrange for the delivery and provision of clinical services to the issuer’s enrollees but the entity is not the issuer with respect to those services;

- The organization contractually bears financial and utilization risk for the delivery, provision, or arrangement of specific clinical services to enrollees;

- The organization delivers, provides, or arranges for the delivery and provision of clinical services through a system of integrated care delivery that, as appropriate, provides for the coordination of care and sharing of clinical information, and which includes programs such as provider performance reviews, tracking clinical outcomes, communicating evidence-based guidelines to the entity’s clinical providers, and other, similar care delivery efforts; and

- Functions other than clinical services that are included in the payment (capitated or fee-for-service) must be reasonably related or incident to the clinical services, and must be performed on behalf of the organization or the organization’s providers.

(CCIIO 2012—001, pg. 2.) Subcontracting delegated entities must become familiar with this Four-Part test in order to comply with MLR requirements.

Starting in 2025, however, DHCS will utilize the yet-to-be-developed new guidance. Subject to CMS final approval, DHCS will issue technical guidance through All Plan Letters and other methods as appropriate. The guidance is expected to be finalized in Fall 2023.

To prepare for these compliance requirements, impacted organizations should consider preparing and implementing appropriate policies and procedures (including those that define the categorization of expenses), staff training, and systems changes, as applicable.

Our Health Law Ticker is a one-stop resource for everything new and noteworthy in healthcare law. We cover recent developments in healthcare legislation, healthcare reform, Medicare/Medicaid, managed care, litigation, regulatory compliance, HIPAA, privacy, peer review, medical staffs and general business operations for healthcare companies and licensed healthcare professionals.

Stay Connected

RSS Feed

RSS Feed